Page 163 - Demo

P. 163

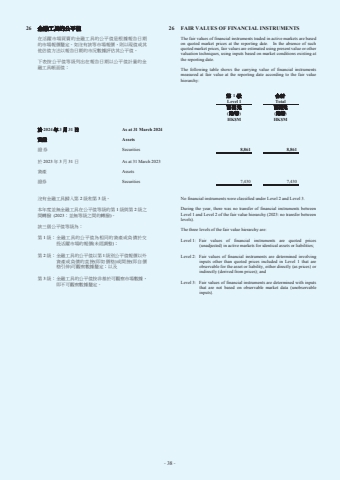

- 38 -- 10 -26 %u91d1%u878d%u5de5%u5177%u7684%u516c%u5e73%u503c 26 FAIR VALUES OF FINANCIAL INSTRUMENTS%u5728%u6d3b%u8e8d%u5e02%u5834%u8cb7%u8ce3%u7684%u91d1%u878d%u5de5%u5177%u7684%u516c%u5e73%u503c%u662f%u6839%u64da%u5831%u544a%u65e5%u671f%u7684%u5e02%u5834%u5831%u50f9%u91d0%u5b9a%u3002%u5982%u6c92%u6709%u8a72%u7b49%u5e02%u5834%u5831%u50f9%uff0c%u5247%u4ee5%u73fe%u503c%u6216%u5176%u4ed6%u4f30%u503c%u65b9%u6cd5%u4ee5%u5831%u544a%u65e5%u671f%u7684%u5e02%u6cc1%u6578%u64da%u8a55%u4f30%u5176%u516c%u5e73%u503c%u3002%u4e0b%u8868%u6309%u516c%u5e73%u503c%u7b49%u7d1a%u5217%u51fa%u5728%u5831%u544a%u65e5%u671f%u4ee5%u516c%u5e73%u503c%u8a08%u91cf%u7684%u91d1%u878d%u5de5%u5177%u5e33%u9762%u503c%ufe30The fair values of financial instruments traded in active markets are based on quoted market prices at the reporting date. In the absence of such quoted market prices, fair values are estimated using present value or other valuation techniques, using inputs based on market conditions existing at the reporting date.The following table shows the carrying value of financial instruments measured at fair value at the reporting date according to the fair value hierarchy:%u7b2c 1 %u7d1aLevel 1%u5408%u8a08Total%u767e%u842c%u5143(%u6e2f%u5e63)HK$M%u767e%u842c%u5143(%u6e2f%u5e63)HK$M%u65bc 2024 %u5e74 3 %u6708 31 %u65e5 As at 31 March 2024%u8cc7%u7522 Assets%u8b49%u5238 Securities 8,861 8,861%u65bc 2023 %u5e74 3 %u6708 31 %u65e5 As at 31 March 2023%u8cc7%u7522 Assets%u8b49%u5238 Securities 7,430 7,430%u6c92%u6709%u91d1%u878d%u5de5%u5177%u6b78%u5165%u7b2c 2 %u7d1a%u548c%u7b2c 3 %u7d1a%u3002%u672c%u5e74%u5ea6%u4e26%u7121%u91d1%u878d%u5de5%u5177%u5728%u516c%u5e73%u503c%u7b49%u7d1a%u7684%u7b2c 1 %u7d1a%u8207%u7b2c 2 %u7d1a%u4e4b%u9593%u8f49%u64a5 (2023%uff1a%u4e26%u7121%u7b49%u7d1a%u4e4b%u9593%u7684%u8f49%u64a5)%u3002%u8a72%u4e09%u500b%u516c%u5e73%u503c%u7b49%u7d1a%u70ba%uff1a%u7b2c 1 %u7d1a%uff1a%u91d1%u878d%u5de5%u5177%u7684%u516c%u5e73%u503c%u70ba%u76f8%u540c%u7684%u8cc7%u7522%u6216%u8ca0%u50b5%u65bc%u4ea4%u6295%u6d3b%u8e8d%u5e02%u5834%u7684%u5831%u50f9(%u672a%u7d93%u8abf%u6574)%uff1b%u7b2c 2 %u7d1a%uff1a%u91d1%u878d%u5de5%u5177%u7684%u516c%u5e73%u503c%u4ee5%u7b2c1%u7d1a%u5225%u516c%u5e73%u503c%u5831%u50f9%u4ee5%u5916%u8cc7%u7522%u6216%u8ca0%u50b5%u7684%u76f4%u63a5(%u5373%u5982%u50f9%u683c)%u6216%u9593%u63a5(%u5373%u81ea%u50f9%u683c%u5f15%u4f38)%u53ef%u89c0%u5bdf%u6578%u64da%u91d0%u5b9a%uff1b%u4ee5%u53ca%u7b2c 3 %u7d1a%uff1a%u91d1%u878d%u5de5%u5177%u7684%u516c%u5e73%u503c%u6309%u975e%u57fa%u65bc%u53ef%u89c0%u5bdf%u5e02%u5834%u6578%u64da%uff0c%u5373%u4e0d%u53ef%u89c0%u5bdf%u6578%u64da%u91d0%u5b9a%u3002No financial instruments were classified under Level 2 and Level 3.During the year, there was no transfer of financial instruments between Level 1 and Level 2 of the fair value hierarchy (2023: no transfer between levels).The three levels of the fair value hierarchy are:Level 1: Fair values of financial instruments are quoted prices (unadjusted) in active markets for identical assets or liabilities;Level 2: Fair values of financial instruments are determined involving inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly (as prices) or indirectly (derived from prices); andLevel 3: Fair values of financial instruments are determined with inputs that are not based on observable market data (unobservable inputs).- 38 -